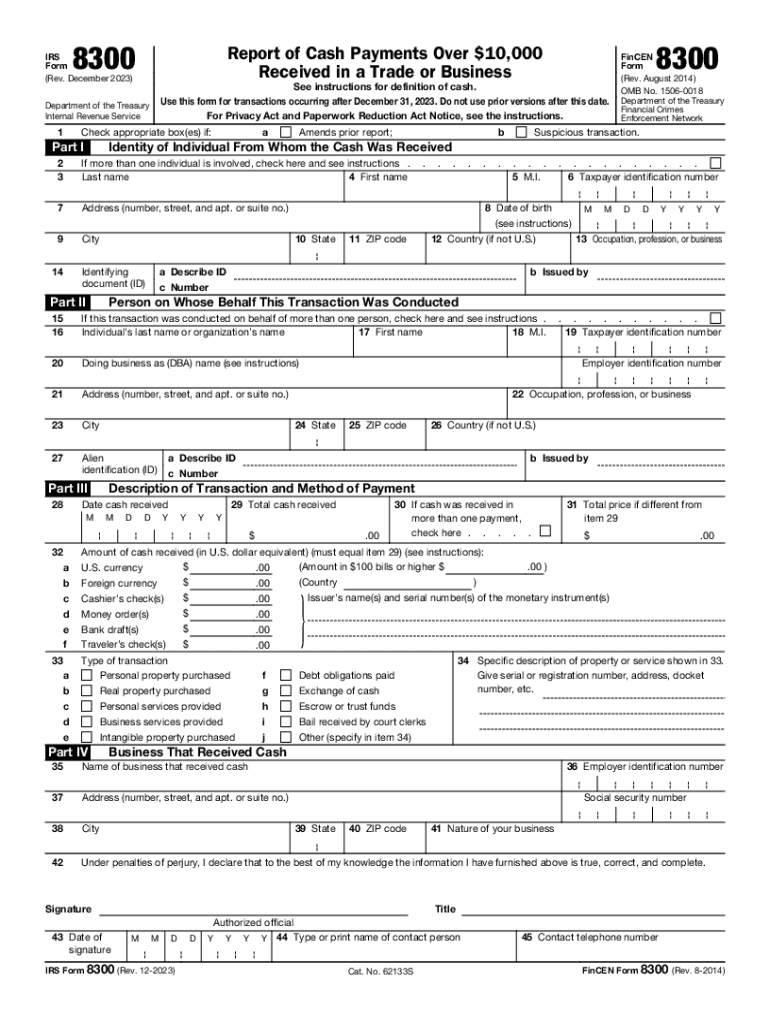

Who Needs Form 8300?

Form 8300 is used by businessmen who received $10,000 or more in cash for one or more business related operations. This form should be also used by court clerks to report the bail of $10,000 or more received from an individual charged for criminal offenses. The form can be also used for a suspicious transaction even if the amount is not more than $10,000. In this case its usage is optional.

What is the Purpose of Form 8300?

The form is used to report transactions connected with a large amount of money ($10,000 and more) or suspicious transactions. The form provides information about the transaction, payer and receiver.

What Other Documents Should Accompany Form 8300?

There is no need to accompany this form with other documents. A copy of this form should be submitted to each person named in the form.

What is the Due Date of Form 8300?

This form is to be filed by the 15th day after the date the money were received.

What Information Should be Provided in Form 8300?

This form has the following sections for completion:

- Identity of individual from whom the cash was received

- Person on whose behalf this transaction was conducted

- Description of transaction and method of payment

- Description of business that received cash

On the second page of the form the preparer can add information about other people connected to the transaction.

What do I Do with the Completed Form?

Once the form is filled out, send it to:

Internal Revenue Service,

Detroit Computing Center,

P.O. Box 32621, MI.